incastle의 콩나물

Chapter2. The Basic Theory of Interest || Part2 본문

2.3 Present and Future Values of Streams

Future Value

-

This formula for future value always uses the interest rate per period and assumes that interest rates are compounded each period

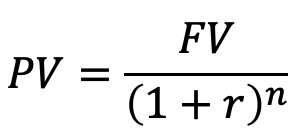

Present Value

-

Present value of a cash flow is the present payment amount that is equivalent to the entire stream

2.4 Internal Rate of Return

IRR

-

IRR is defined without reference to a prevailing interest rate

-

Determined entirely by the cash flows of the stream

-

Higher internal rate of return means the rate of return from investing V0 is high

- For any cash flow stream, the IRR is the interest rate that makes the present value of the stream to be zero

2.5 Evaluation Criteria

Evaluation with Net Present Value

-

Alternatives with higher present values are more desirable

-

All cash flows associated with the investment must be included (both positive and negative)

-

Net present value (NPV): Present value of benefits minus the present value of costs

-

Only investments with positive NPV are worthy of consideration

Evaluation with Internal Rate of Return

-

Alternatives with higher IRR are more desirable

-

Investment is not worth considering unless its IRR is greater than the prevailing interest rate

(IRR이 이자율보다 높지 않으면 투자 가치가 없습니다, 여기서는 비슷한 위험도라는 가정하에!)

NPV vs IRR

-

NPV: simplest to compute; can be broken into component pieces

-

IRR: depends only on the properties of the cash flow stream; does not require external interest rate

-

For one-time investments, NPV may be more appropriate

-

If future cash flows from reinvestment were modeled, NPV may provide the same recommendation as IRR

-

One approach is to use NPV as the first evaluation criterion and check IRR to confirm the result

-

NPV and IRR are good starting points but other factors also need to be considered

'20-1 대학 수업 > 금융공학' 카테고리의 다른 글

| Chapter4. Term Structure of Interest Rate || Part.1 (0) | 2020.04.17 |

|---|---|

| Chapter3. Fixed-Income Securities || Part2 (0) | 2020.04.16 |

| Chapter3. Fixed-Income Securities || Part1 (0) | 2020.04.14 |

| Chapter2. The Basic Theory of Interest || Part1 (0) | 2020.04.12 |

| Chapter1. Introduction (0) | 2020.04.12 |