incastle의 콩나물

Chapter4. Term Structure of Interest Rate || Part.2 본문

4.3 Forward Rates

Forward Rates 1

-

Concept of forward rates emerges from the definition of spot rates

-

Forward rates: Interest rates for money to be borrowed between two dates in the future, but under terms agreed upon today

미래에서 시작해서 미래에서 끝난다.

-

For investing $1 for two years, there are two alternatives

-

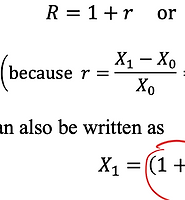

Invest $1 in a 2-year account and receive (1 + s_2)^2

한 번에 2년 담가 -

Invest $1 in a 1-year account and then another 1-year account, which gives (1+s_1)(1+f)

1년 짜리 한 번 담그고 1년 뒤에 또 1년짜리 담가

-

- 1번과 2번은 같아야 한다. 따라서 아래와 같이 유도가 된다.

Forward Rates : Arbitrage Argument

- Arbitrage argument, 차익 거래 논쟁:

- Arbitrage: riskless profit

-

If the two methods of investing money did not return the same amount, then there would be an opportunity to make arbitrage profits

위에서 처럼 1번과 2번의 이득이 같지 않다면, arbitrage profit이 생겨 버림 -

If (1 + s_2)^2 < (1 + s_1)(1 + f), then an arbitrageur could borrow for 2 years and then carry out the second plan by investing the money that is borrowed

- If a slight discrepancy does arise, they take advantage and this action tends to close the gap in rates

보통 이런 arbitrage profit이 발생하면 시장 논리에 의해서 없어짐

Forward Rates 2

-

f_t1_t2 => It is the rate of return charge for borrowing money at time t_1 which is to be repaid (with interest) at time t_2

-

Generally expressed on an annualized basis

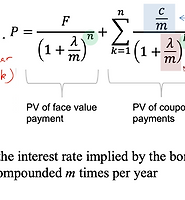

- Calculated forward rates are often termed implied forward rates

Implied Forward Rates

-

Suppose we continue to use 1-year compounding, then forward rates between periods i and j where i < j

User of Forward Rates

- Forward rates are introduced partly because they represent rates of actual transactions

- Forward contracts do serve a very important hedging role

hedgine : 양쪽에 걸어 손실을 방지하다

4.5 Expectations Dynamics

Spot Rate Forecasts

-

Market expectations that explain the shape of the spot rate curve can be developed into tools to form forecasts of future interest rates

- We can predict next year’s spot rate curve from the current one

- Going forward, an entire future of spot rate curves can be predicted

'20-1 대학 수업 > 금융공학' 카테고리의 다른 글

| Chapter 6. Mean-Variance Portfolio Theory || Part 1 (0) | 2020.05.16 |

|---|---|

| Chapter4. Term Structure of Interest Rate || Part.3 (0) | 2020.04.20 |

| Chapter4. Term Structure of Interest Rate || Part.1 (0) | 2020.04.17 |

| Chapter3. Fixed-Income Securities || Part2 (0) | 2020.04.16 |

| Chapter3. Fixed-Income Securities || Part1 (0) | 2020.04.14 |