incastle의 콩나물

Chapter 6. Mean-Variance Portfolio Theory || Part 1 본문

주식이란?

-

Stocks represent a fraction of ownership in a business

주식은 사업체의 소유권의 일부를 나타냅니다 - A single share of the stock represents fractional ownership of the corporation in proportion to the total number of shares

Portfolio Management

- Our goal : Form the best portfolio among various assets

- How are we going to decide which portfolio is the best?

- ==> We will consider two measures: Portfolio return and risk

- portfolio의 return과 risk를 어떻게 계산하느냐?

- 개별 주식들의 return을 통해서 계산한다.

- But it is difficult because we are not sure which stocks will go up and which stocks will go down

- However, returns are not completely random because historical movements provide some information

- We can use the mean (expected value), variance, and covariance of stock returns

6.1 Asset Return

Asset Return

- Asset(자산) : 자주 사고 팔 수있는 투자 수단

- Rate of Return

Portfolio

-

Suppose now that n different assets are available

- We can form a master asset or portfolio of these n assets

- 주식마다 쪼개서 다른 금액을 투자할 수 있음(만약 short투자가 가능하면 음수도 됨)

- Amounts invested can be expressed as fractions of the total investment

- where w_i is the weight or fraction of asset i in the portfolio

특정 주식 i에 얼마나 투자했냐를 전체 투자 금액에 가중치(w)를 할당함으로써 표기할 수 있음 - 당연히 weight들의 합은 1이다.

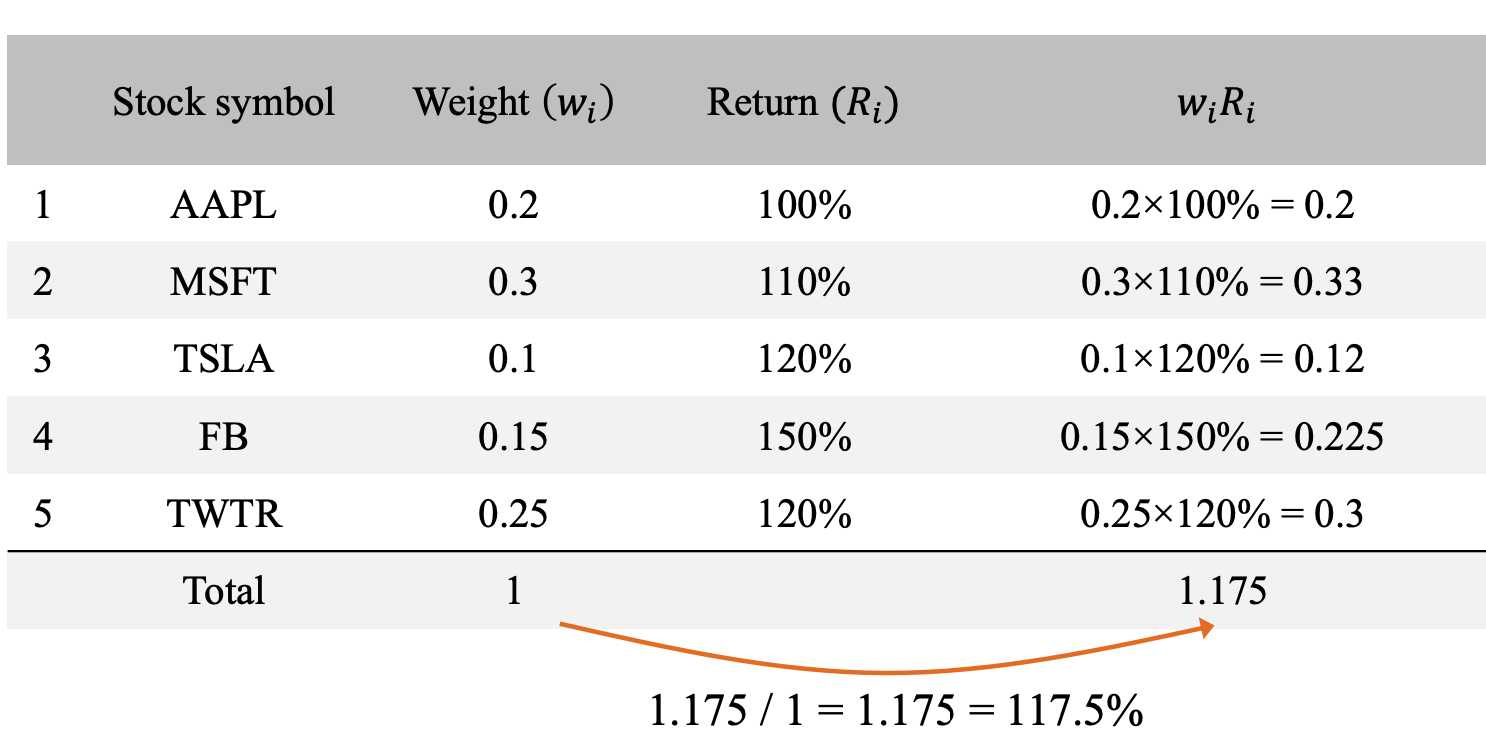

Portfolio Returns

-

Let R_i denote the total return of asset i

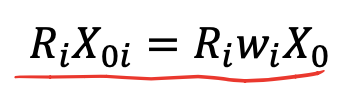

- Amount of money generated at the end of the period by the ith asset is

-

Total amount received by this portfolio at the end of the period is

- Overall total return of the portfolio is

- 개별 주식에 투자한 가중치 * 전체 투자 금액 * 개별 주식의 수익률 = 개별 주식의 return이 된다. (사실 당연한 이야기)

- 개별 주식 수익

- 전체 수익

- overall total return of portfolio

- R은 투자 금액을 몰라도 알 수 있다, 투자 비율만 알면 산출 가능하다.

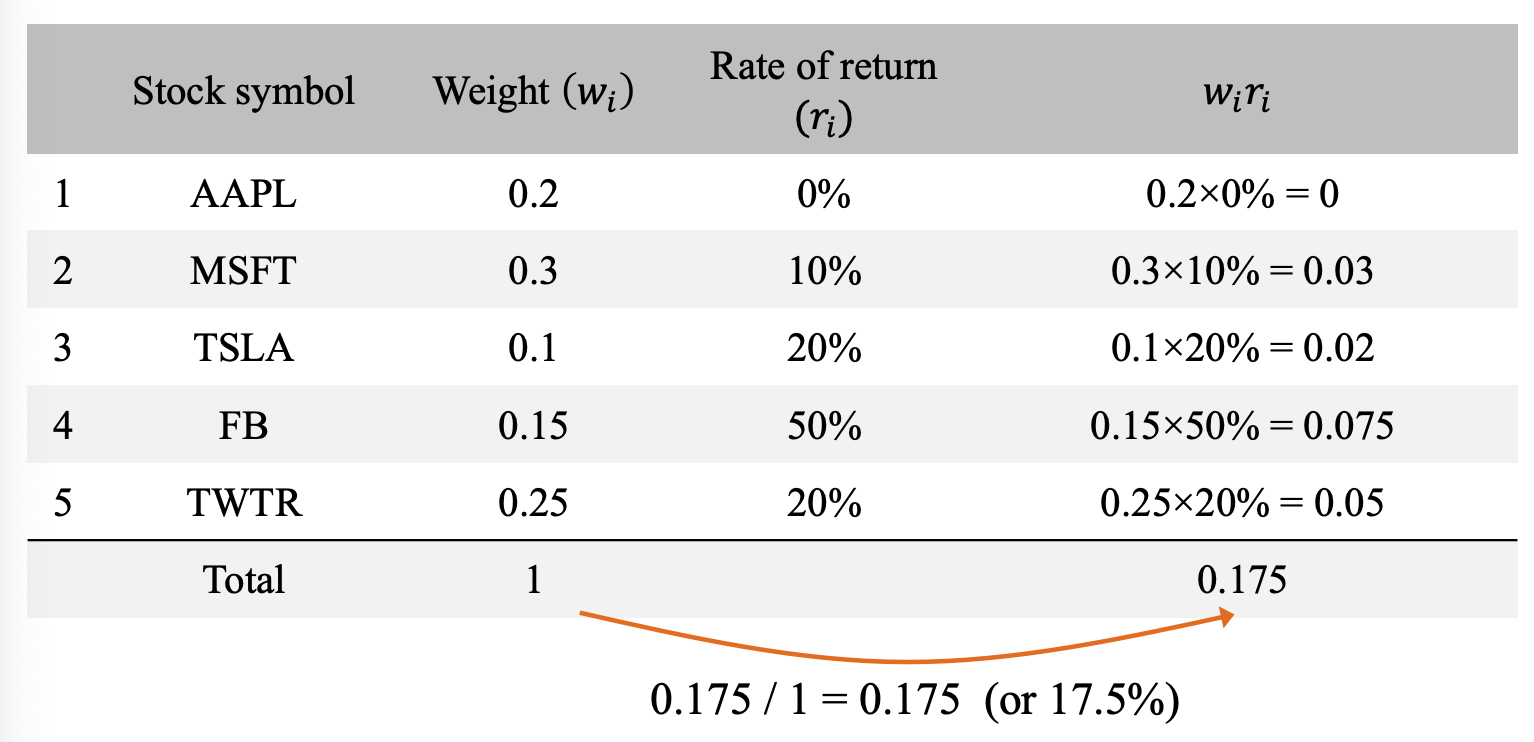

- Return을 곱하는 게 아니라, Rate of return(r_i)를 곱해도 똑같다.

Short Sales(공매도) 1

- Short selling or shorting: Process of selling an asset that you do not own

- Borrow the asset from someone who owns it (such as a brokerage firm)

- Then sell the borrowed asset to someone else, receiving an amount X_0

- At a later date, you repay your loan by purchasing the asset for X_1 and return the asset to your lender

- If the later amount X_1 is lower than the original amount X_0, you will have made a profit of (X_0 - X_1)

- Short selling is profitable if the asset price declines

Short Sales(공매도) 2

-

Short selling is considered risky (even dangerous) by many investors

- Potential for loss is unlimited

- If the asset value increases, the loss is X_1 - X_0. but X_1 can increase arbitrarily (so can the loss)

'20-1 대학 수업 > 금융공학' 카테고리의 다른 글

| Chapter 6. Mean-Variance Portfolio Theory || Part 4 (0) | 2020.05.17 |

|---|---|

| Chapter 6. Mean-Variance Portfolio Theory || Part 3 (0) | 2020.05.17 |

| Chapter4. Term Structure of Interest Rate || Part.3 (0) | 2020.04.20 |

| Chapter4. Term Structure of Interest Rate || Part.2 (0) | 2020.04.20 |

| Chapter4. Term Structure of Interest Rate || Part.1 (0) | 2020.04.17 |

Comments