incastle의 콩나물

Chapter 8. Investment Science || Part.1 본문

8.2 Factor Models

Inputs of M-V model

- n개의 주식이 있을 때, mv모델을 만드려면

- n mean value

- n variance

- n(n-1)/2 covariances

- 총 2n+n(n-1)/2 개의 파라미터가 필요하다. n이 크면 클수록 더 많은 값들이 필요함

Factor Models

- 여러개의 주식을 아우를 수 있는 어떠한 Factors를 찾으면 간단하게 표현할 수 있음

- Factor와 개별 mean 간의 연관성을 나타내는 Factor model은 asset 간 공분산 구조를 단순화한다.

- For common stocks, the factors might be the size of a company, gross domestic product (GDP), unemployment rate, and so forth

Single - Factor Model

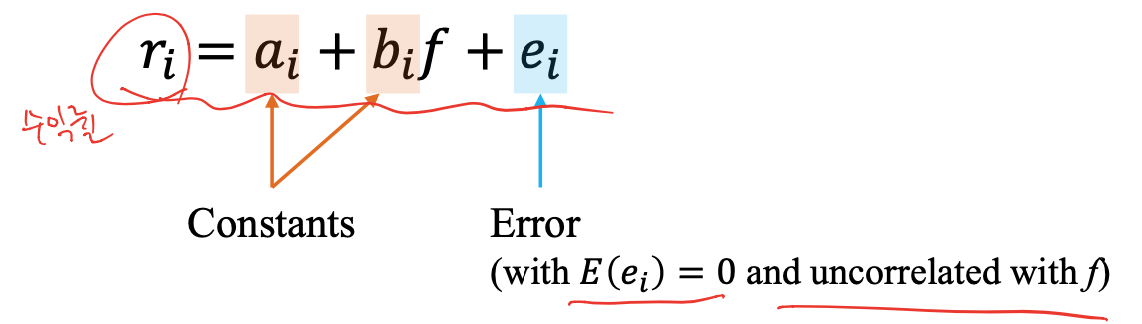

-

Single-factor models are the simplest of the factor models

- There is a single factor f which is a random quantity

- We assume that some value y and the factor are related by

- The b’s are termed factor loadings because they measure the sensitivity of the return to the factor

b는 factor에 의존하는 정도를 나타내는~

- 이번에는 y가 r_i(수익률)이라고 생각해보자.

- single-factor model은 linear fit으로 보여질 수 있다.

- Imagine that several independent observations are made of both the return r_i and the factor f

- Since both are random quantities, the points are likely to be scattered

- A straight line is fitted through these points

- single-factor 모델을 사용하면, mean-variance model의 파라미터들을 결정할 수 있다.

=> Now we just need a total of 3n+2 parameters

-

When asset returns are described by a single-factor model, the return of any portfolio of these assets is described by a factor model

'20-1 대학 수업 > 금융공학' 카테고리의 다른 글

| Chapter 10. Forwards, Futures, and Swaps (0) | 2020.06.08 |

|---|---|

| Chapter 8. Investment Science || Part.2 (0) | 2020.06.07 |

| Chapter7. The Capital Asset Pricing Model || Part.2 (5) | 2020.05.18 |

| Chapter7. The Capital Asset Pricing Model (0) | 2020.05.17 |

| Chapter 6. Mean-Variance Portfolio Theory || Part 4 (0) | 2020.05.17 |

Comments